In his two volume book, Escape the City, Travis Corcoran listed prices of various goods used in homesteading. Because he recorded the price, he was able to notice that these prices fluctuated much higher than the government published rate of inflation even in the months while he was writing the book. He then made his followers on Twitter aware of this curious discrepancy between government CPI statistics and actual real-world prices.

As discussed in part 1, rising prices are generally caused by inflation or market interference (e.g. government regulation). Inflation itself can have many causes, but most of recent inflation has been caused by government interference: extreme spending and lockdown-caused ripple-effects to the economy.

The reality is that in a mere 1 to 3 years, many things have increased in price by 30%, 50%, or even 100%, far exceeding the published inflation numbers. But almost nobody keeps close watch on what they once paid, so they can lie about it quite easily.

Many readers—who are probably smeared as conspiracy theorists—know this intuitively. They know prices are insanely inflated without possessing the proof that Corcoran found. They deny the official narrative and are correct to do so.

This cost:

- $5.90 in July, 2017

- $6.94 in January, 2019

- $8.20 in October, 2021

- $7.98 in February, 2022

- $8.66 in October, 2023

Notice that although the much inflation occurred after covid lockdowns, inflation was also high before that. This is nearly 50% inflation in only 7 years.

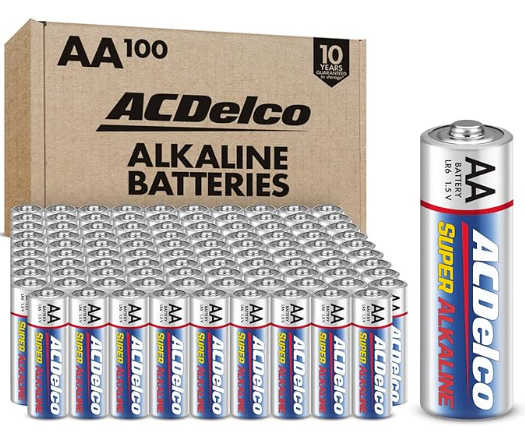

This cost:

- $23.51 in October, 2019

- $23.84 in April, 2020

- $24.98 in December, 2020

- $27.70 in October, 2023

Batteries increased by 18% over the last 3 years, which is much less than food, but it wasn’t inflating before that. Moreover, prices for technology usually decline over time or at least inflate much slower than overall inflation.

Consider how Amazon’s “Amazon Basics” brand has put significant price pressure on other brands, and yet despite this, prices have *still* inflated. These cost $25.76, just a few cents less than the ACDelco batteries. Since 96 Energizers costs $44, imagine the price without this recent competition!

With the inflation of batteries in mind, consider a tech product like USB cables, which cost $9.99 (list price) in 2018, but still sells $8.99 (on sale) to $10.99 (list price). Technology like this generally doesn’t inflate like other goods and often decreases over time. But batteries increased by a lot!

This cost:

- $11.99 in November, 2021

- $11.99 in October, 2022

- $13.99 in July, 2023

- $13.99 in October, 2023

Notice how it fast the 17% inflation arrived.

This cost:

- $13.22 in September, 2017

- $19.60 in July, 2023

This is ~50% inflation over five years.

I don’t purchase multiples of many items and I don’t keep all my receipts, so my examples are quite limited. Even so, it was trivial to find a couple that have inflated 50% over the last five years. I suspect I could find many such cases if I’d continue to look.

We could talk about how the price of lumber doubled (or more) as a result of logistics failures caused by unnecessary lockdowns, forcing many people to spend way more than they wanted on their building projects.

But let’s talk about food prices.

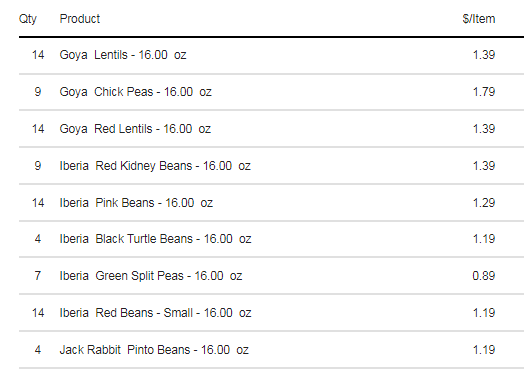

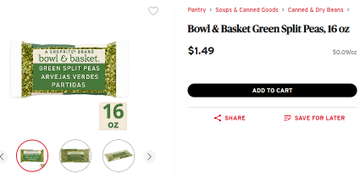

During 2020, I stocked up on dried beans, lentils, peas, and chick peas, with prices as low as $.89 per bag.

Now prices are $1.49 to $2.39. Yes, I bought 90 pounds of dried beans, lentils, peas, and chick peas in 2020, which cost $118 before taxes. Today that would cost $164, an increase of 40% for what is still one of the cheapest staples you can buy.

For goods with a 10-20+ year shelf life when properly stored, stocking up at low prices was a no-brainer, because it was obvious that inflation was going to sink its claws into food prices and shortages could occur at any point. Many of us saw this coming.

Don’t be fooled by those who blame rising prices on capitalism, in order to hide their culpability (politically or ideologically) in the inflation that has hit us all.

I feel sorry for families right now. I have no idea how they make ends meet right now.

I remember hearing the statistic that in 1930, food accounted for 24% of family spending . It shocked me because at that time (2010) food accounted for 8% of household income.

I suspect it is closer to the depression era figure than the 2010 figure today.

My biggest concern is that there appears to be nothing that can stop what is coming. The time to prepare is now.