One of the political views that I find most frustrating is that America is full of greedy capitalists who—if they were destroyed by socialists and communists—would usher in a period of economic prosperity that no society has ever experienced. This is all a complete fabrication of reality. The reality is that prices have been rising due to inflation, almost solely caused by the actions of governments.

In an optimal capitalist market, nobody makes a profit, but everyone’s needs are satisfied. How can this be? The answer lies in Economics 101.

If supply and demand are elastic and not artificially limited (e.g. by government regulated price controls) and costs are fixed, then at the point of optimal competition (i.e. no arbitrage possible), the price of goods will fall to the point where profit is $0. Optimal capitalism is where no one makes a profit and goods and services are as cheap as they possibly can be.

The mechanism that enables this is called arbitrage. Any deviation between costs and price is an arbitrage opportunity that another seller can step in to undercut the competition by buying goods a higher price and/or selling goods at a lower price, keeping the difference as pure profit. In modern electronic markets this is typically done by a middle man in a riskless single transaction where one buys from a seller and then immediately sells to a buyer while pocketing the price difference, but the concept can be generalized to any market action, including risky ones.

Say I am selling tomatoes for $4.00/lb, but it only costs me $1.00/lb to buy them from a farmer. This gives me a massive profit of $3.00/lb. Now, you come along and realize that because the production market for tomatoes is $1.00/lb and the retail price is $4.00/lb, that you could buy them from the farmer at $1.10/lb and sell them for $3.90/lb. You’ll make less profit than me, but you’re still making money and undercutting both my supply and my retail price, so who cares? If this process continues in a free market, eventually the difference between the production market and the retail market approaches zero, as competition eliminates profit, costs fall (incentivized by increased profits), and goods reach an equilibrium “market price.”

Some examples of industries where both the barriers to entry and the profit potential are very low include fast food franchises, gas stations, and grocery stores. If profit were much lower, the businesses would largely fail due to negative profit. This is because arbitrage opportunities in these industries are very low. This is also why McDonald’s is such a good deal, nearly the best it can be.

In the financial world, consumers who issued online stock trades used to pay large transaction fees. But, discount financial brokerages arbitraged it to death until the fees were almost completely eliminated.

The paradox, then, is that the more “greedy” business owners are, the better it is for the consumer, as prices—and thus profit—fall due to “greedy” exploiters of arbitrage. Conversely and ironically, rising prices are a sign of inflation and/or artificial price influences (e.g. regulation) and/or poor competition and/or lack of so-called greed.

Here is the key: cost reduction due to ever better capitalist market optimization has hidden the true inflation rate. Cost reduction isn’t monetary deflation, but it hides the real, very huge rise in monetary inflation. Without the cost reductions of recent decades—fueled by technology and better education—inflation would have raged out of control. Instead, the inflation still happened, but it was partially offset by ‘greedy’ capitalism.

Because their profit is so low, highly optimized industries—like fast food, grocery, and fuel—are highly susceptible to inflation. When costs go up, due to inflation, this will be reflected in the price of goods almost immediately, lest the sellers of goods take a negative profit and go out of business. So when those industries experience skyrocketing prices, you should blame your government for inflating away your wealth and income.

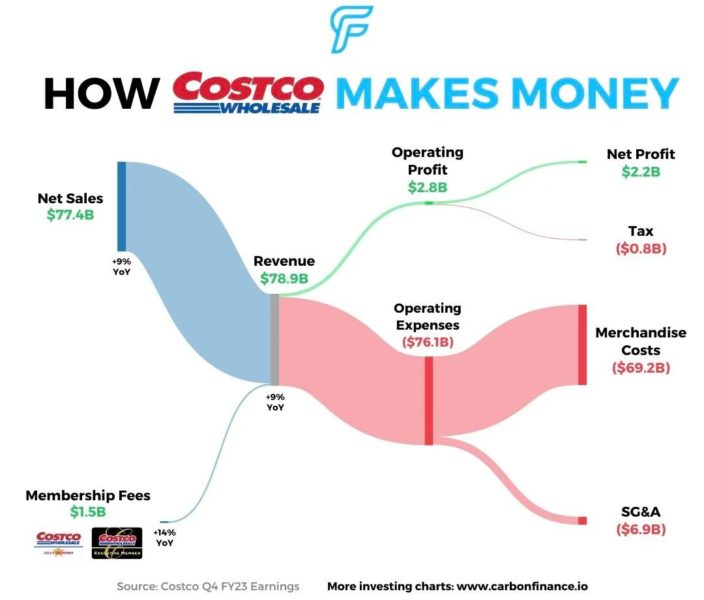

Costco is the perfect example. It is a massive company in the highly optimized sector, taking in $77.4 billion in sales each year, with expenses of $76.1 billion. Excluding membership fees, Costco leaves a profit for investors of only 1.7%! This is barely enough to cover unexpected, fluctuating cost changes to keep year-on-year profit above negative.

Many consumers have seen prices rise by 50% or even 100%, seemingly overnight, due to the rapid onset of inflation. This is most visible in these industries, where there is very little arbitrage opportunity in that sector because there is so very little profit to be made.

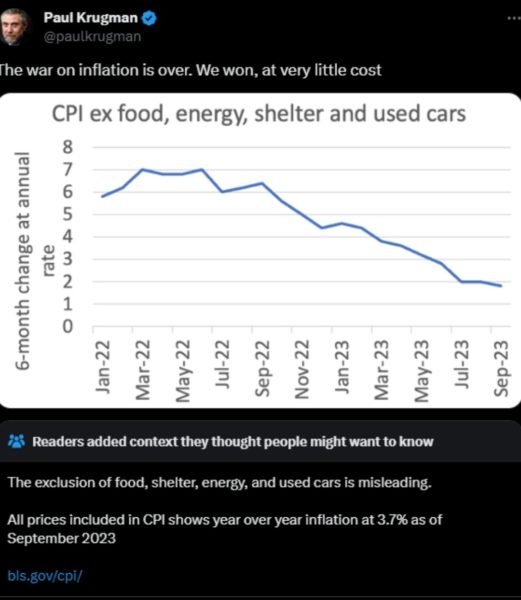

Food, energy, shelter, and used cars are all highly optimized, low profit industries, as shown by their propensity to move quickly in price due to changing market impacts. Paul Krugman—a shill for the State—removes the industries most sensitive to inflation—those most unable to reduce profit—in order to make it seem as if inflation isn’t that bad. Meanwhile, normal people—who do not understand economics—do not comprehend why a business would continue to exist as its profit approaches 0%. They incorrectly blame greed. They should be blaming government for monetary inflation and reckless spending.